AUSTRALIA’S PROPERTY MARKET

As we progress into the new year, discussions continue about the future of Australia’s property market, and what we can look forward to in the coming months regarding property prices.

Australia’s national housing upswing has continued through the first month of 2024 with CoreLogic’s National Home Value Index rising 0.4% in January and 1.0% in the three months to January, which is the smallest quarterly increase since the March quarter of 2023 (1.0%).

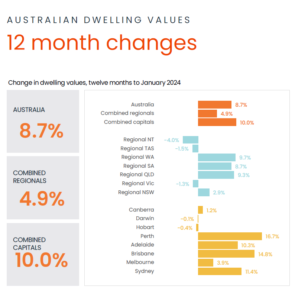

CoreLogic (a property data resource) also stated that despite the easing in quarterly growth, home values increased 8.7% over the year to January, the highest annual increase since the year to June 2022 (10.8%).

It is well known that Australia’s housing market is heaving impacted by the capital cities, so when looking at changes in dwelling values in Australia it is important to keep in mind that regional markets are very different to that of the capital cities.

CoreLogic reported that the change in dwelling values in 12 months in regional QLD was a 9.3% increase, which is 0.6% higher than Australia’s average (see below chart).

(CoreLogic – Monthly Housing Chart Pack February 2024)

While there is talk of a decrease in property values across Australia, a deeper look into our housing market shows that this talk is centered around the Melbourne and Sydney markets.

While Melbourne dwelling values are now -4.2% below the record high, which was in March 2022, the January 2024 dwelling value declined only by -0.1%. It is also a similar case for Sydney, with dwelling values now -2.4% below the record high, which was in January 2022, whereas in January 2024 Sydney dwelling values rose by 0.2%.

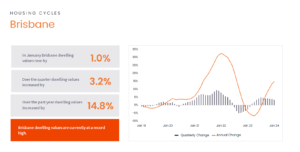

But looking at our nearest Capital City, Brisbane, it is a totally different case. CoreLogic states that Brisbane Dwellings are currently at a record high, with the January 2024 Brisbane dwelling value rising by 1.0%, the quarterly value rising by 3.2% and the value of the past year rising by 14.8% (see below chart).

(CoreLogic – Monthly Housing Chart Pack February 2024)

MAREEBA’S PROPERTY MARKET

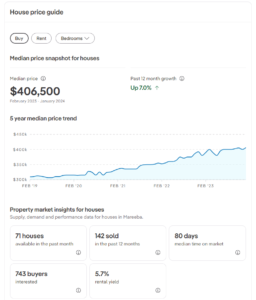

Taking a look at Mareeba’s housing market, this increase is continuing in our area, despite the talk of housing prices decreasing in the coming months.

According to realestate.com.au’s suburb profile of Mareeba, we have seen a 7% median price growth over the past 12 months, and the median property price in Mareeba is currently $406,500 (see below chart).

(Realestate.com.au – Mareeba Suburb Profile February 2023 – January 2024)

WHAT AFFECTS PROPERTY PRICES?

In order to understand the housing market, and property values across Australia, it is important to look at the major factors that affect our housing market. Property prices are driven by a combination of factors, and as we move through property cycles, they all come together to influence whether property values rise or fall.

Understanding how these concepts work together to affect real estate is crucial to one’s understanding of what’s ahead for our housing markets.

Interest Rates

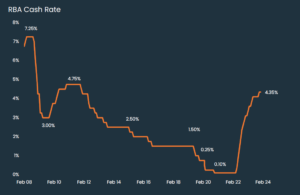

While many people believe interest rates are a key driver of property values, and that’s why there were so many pessimistic property forecasts as interest rates rose through 2022-23, our housing markets showed considerable resilience and kept rising in value despite the 13-interest rate rises the RBA threw at us.

Of course, falling interest rates and the subsequent increased affordability are strong drivers of property price growth, but the reverse isn’t true.

House prices are driven by many other factors, not just interest rates.

Here are a few statement highlights from the recent RBA meeting.

- At the February meeting, the Board decided to leave the cash rate target unchanged at 4.35%.

- The Board noted progress on inflation, which came in under the November forecasts, but remains high. Inflation forecasts have been downgraded to reach 3.2% by the end of the year.

The below chart shows the RBA Cash Rate over the past 6 years.

(CoreLogic – Monthly Housing Chart Pack February 2024)

Supply and Demand

Another major factor contributing to market value is supply and demand. Housing supply has a significant influence over house prices in the short term: an undersupply puts pressure on prices to rise while an oversupply does the opposite.

It has been well known over the past few years that supply has been low and demand has been high, which has been shown through numerous properties selling not only within days of hitting the market, but also multiple sold off market as well.

Below are numbers from PriceFinder (a property data resource) showing the number of sales in Mareeba each year from the beginning of 2020 to the end of 2023, spanning across houses, units, and vacant land.

As you can see, the number of properties sold over the last two years has significantly decreased. With less properties coming onto the market, and the strong absorption of new listings for sale has kept total listings in the market suppressed, intensifying competition between buyers.

These factors have created a sharp shortage of housing, outweighing the negative impact of rates on prices.

WHAT TO EXPECT IN 2024

While no one can be certain what the market will do in time, looking at market trends and other contributing factors give great insight into what we can expect.

In 2024 we can look forward to a steady market, with the potential for a slight increase in prices, as the volume of properties on the market remains low, and the need for housing remains high, but with inflation hitting hard over past few the years the ability to save and buy a home becomes harder for the average person.

If you are interested to know more about Mareeba’s Property Market and understand the value of your property in our current market get in touch with our experienced team for your personalised market update.